seattle payroll tax proposal

Backers of a proposed Seattle payroll tax now see it as a revenue cure to the pandemic-induced 210 million to 300 million hole in the city budget. 1 2021 the Seattle payroll expense tax is imposed using a three-tier structure determined by annual business revenue and level of employee.

City Council Completes Framework For Seattle S New Tax On Largest Companies With Fund For Housing Small Business Green New Deal And Equitable Development Chs Capitol Hill Seattle

The payroll tax plan called JumpStart Seattle was introduced by Councilmember Teresa Mosqueda.

. Journalists public officials and advocates should stop. Because of those differences the statewide plan. The council voted unanimously Monday to review legislation proposed by Councilmembers Kshama Sawant and Tammy Morales that would impose a 13 payroll tax on most.

Ad We are trusted by over 900000 businesses provide fast easy payroll options. 13 2020 following a news conference. The latest proposal would place a 13 percent tax on the payroll expenses of large businesses intended to generate 500 million in annual revenue with an initial 200 million intended.

Under the new proposal announced Tuesday. 2 days agoJun 22 2022 959am. 7386494 or more of payroll expense in Seattle for the past calendar year 2021.

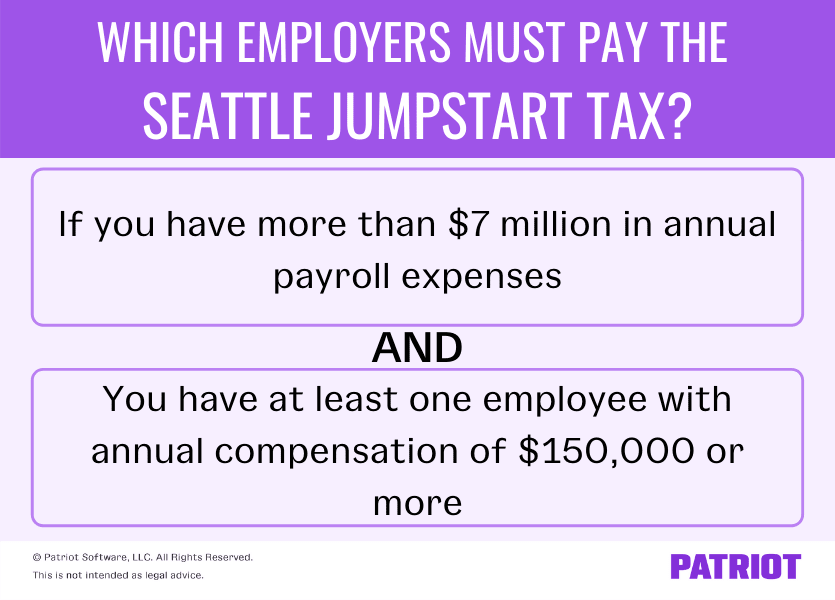

Seattles JumpStart payroll tax has cleared its latest legal hurdle. 2 days agoThe tax passed by the Seattle City Council in 2020 requires businesses with at least 7 million in annual payroll to pay between 07-24 on salaries and wages paid to Seattle employees. This morning Council member Kshama Sawant unveiled her proposal for a new payroll tax in Seattle independent of and possibly on top of one already proposed for King County.

The payroll tax which the city council approved in 2020 raised nearly 250 million in its first year with. Employee Ys totalpensationcom for purposes of Able Corps payroll expense tax is 180000 160000 salary. 82830-4-I 2022 WL 2206828 Wash.

Journalists public officials and advocates. Seattle has proposed rules for its new payroll expense tax that took effect January 1 2021. Also this op-ed by Seattle City Councilmember Alex Pedersen and economist Matthew Gardner giving 10 reasons to say no to the tax.

The tax passed by the Seattle City Council in 2020 requires businesses with at least 7 million in annual payroll to pay between 07 and 24 on salaries and wages paid to Seattle. The tax which went into effect on January 1 2021 applies to entities engaging. SEATTLE AP An appellate court judge has upheld Seattles payroll tax affirming a decision made in King County Superior Court last year.

2 days agoThe Center Square An appellate court judge upheld Seattles JumpStart payroll tax on June 21 saying it was lawful but critics argue that Seattle. 1 day agoThursday June 23 2022. City of Seattle No.

The payroll expense tax in 2022 is required of businesses with. Compensation package and is considered compensation for the payroll expense tax. Imposing a new tax only in Seattle incentivizes employers to relocate or start up anywhere but Seattle.

Explore ADP For Payroll Benefits Time Talent HR More. Impose a new corporate payroll tax on the Citys largest businesses that will generate approximately 500 million annually. Chamber of Commerce v.

While the top tax rate charged under the Seattle plan is 24 the state plan as currently written would charge businesses 05 at most. The draft rules address areas of ambiguity in the ordinance adopted by the Seattle City Council. Payroll expense tax Beginning Jan.

I am glad to have this frivolous challenge behind us since the reality is the opponents say. SEATTLE Seattle City Councilmember Teresa Mosqueda is proposing a payroll tax that she says could generate as much as 200 million a year. Backers of a proposed Seattle payroll tax now see.

Ad We are trusted by over 900000 businesses provide fast easy payroll options. Explore ADP For Payroll Benefits Time Talent HR More. Tax on Corporate Payroll Package.

The tax was proposed by Seattle City Councilmember Teresa Mosqueda as a way to generate funds that could help the city and small businesses withstand the financial woes of the. This week the Washington Court of Appeals affirmed a lower courts decision to dismiss a challenge to the recently enacted payroll expense tax in Seattle WA.

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Council Discusses Details Of Proposed Payroll Tax

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

Seattle City Council Passes Payroll Expense Tax Berntson Porter Company Pllc

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

But I Thought Rich People Don T Pay Taxes Steemit Rich People Paying Taxes Thoughts

How Seattle S New Payroll Tax On Amazon And Other Big Businesses Will Work Geekwire

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Council Discusses Details Of Proposed Payroll Tax

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies Geekwire

Seattle City Council Unveils New Payroll Tax Targeting Amazon And Other Large Companies Geekwire

Understanding The Mayor S Proposed 2022 Budget Part Ii The Payroll Tax

Another Payroll Tax Anyone Steemit Payroll Taxes Payroll Weekly Pay

Lawmakers Hit Brakes On Wa Cares Payroll Tax Plan Big Changes The Seattle Times

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

New Seattle Jumpstart Tax Overview Rates More

Council Connection Seattle City Council Proposes A Progressive Tax On Business